Published by DS Tractor Blog

The Chinese agricultural machinery market is undergoing remarkable changes—not only in terms of technological advancement, but also in terms of brand preferences and geographic sales dynamics. One of the most interesting and underreported phenomena is the “great migration” of tractors: many brands are being sold far from their place of manufacture, with consumer loyalty varying dramatically across provinces.

This article provides a deep dive into China’s shifting tractor sales trends, based on the distribution data of nearly 200 domestic tractor manufacturers, while revealing what farmers truly want in their machines.

Brand Loyalty is Local—and Psychological

Across China, farmers tend to favor tractor brands that resonate with local culture, color schemes, and historical familiarity. In the northeast provinces such as Jilin, Heilongjiang, and Liaoning, there's an unmistakable love for “Deere green” tractors—so much so that local buyers often gravitate towards brands containing the character “野” (meaning “wild” or “field”), such as 奔野 (Benye).

While these preferences may appear to be brand-based, they are also rooted in aesthetics and perceptions of durability. For example, even companies that no longer carry the original Benye name have thrived by using similar green paint jobs, reflecting consumers’ deep emotional and practical connection to legacy designs.

Northeast Market: The Kingdom of "Benye" and the Green Wave

The northeast—particularly centered around Jilin—is a unique market where most tractors originate from other provinces, yet specific aesthetic and naming conventions dominate.

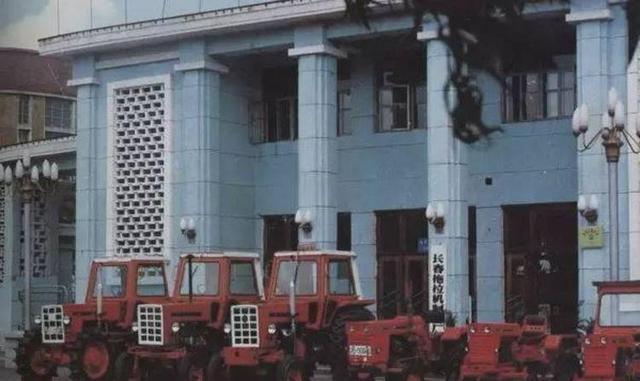

The original Benye brand was born in Ningbo, Zhejiang, and quickly gained traction in Jilin after the fall of Changchun Tractor Factory, one of China’s original “big three” manufacturers founded in 1959. When the factory fell into difficulty in the 1990s, farmers turned to alternatives, such as Nanchang’s Fengshou and Ningbo’s Benye.

Ningbo Benye eventually thrived, gaining a reputation for affordability and durability. In 2007, John Deere acquired the company, upgrading the machines but also raising prices. As a result, many farmers nostalgically preferred the older, simpler models—creating a boom in brands using similar names or aesthetics.

Today, the term “Benye” is broadly used across various companies:

- Weifang Dashen Benye sold nearly 6,000 units

- Ningbo Beiye sold 3,000+

- Ningbo Benye Heavy Industry: 2,500+

- Zhongchi Benye (Weifang): nearly 2,000

The green paint itself has become a sales driver. Brands like Weifang Huaxia and Jiamusi Jichi have achieved notable success in the northeast simply by adopting the “Deere green” color, even if the names or structures differ.

Xinjiang Market: East Wind Prevails

Unlike the northeast, Xinjiang is a vast and uniquely demanding region for agricultural machinery. Climate, terrain, and scale all play a role in shaping consumer preferences. Here, the top-selling brand has been Changzhou Dongfeng Tractor, also known as "East Wind."

In 2022, Dongfeng sold over 4,000 tractors in Xinjiang—far ahead of competitors such as China YTO (3,600 units), Weichai Lovol (2,300), and John Deere (1,000). Despite the region's tough operating conditions, Dongfeng has managed to meet user expectations through machine robustness, reliability, and adaptation to regional needs.

Central Plains: Red Tractors from Luoyang Dominate

The Central Plains region, including Henan, Hebei, and surrounding provinces, show strong loyalty to red-painted tractors—especially those under the famous Dongfanghong (东方红) brand from China YTO in Luoyang.

China YTO was among the earliest tractor manufacturers in China, and many of today’s engineers and production experts in the tractor field were trained there. Numerous smaller brands have also emerged nearby—such as Luoyang Wannianhong and Luoyang Fengshou—capitalizing on the proximity to this industrial legacy.

Even in provinces like Shandong, where the most tractors are produced, Dongfanghong remains a top seller. The "Luoyang red" finish has become as symbolic to local farmers as "Deere green" is to northeastern buyers.

Shandong & Weichai Lovol's Rise

While China YTO remains the industry leader, Weichai Lovol is rapidly closing the gap. From a market share of just over 10% in 2020, Lovol reached more than 15% by 2022, driven by post-merger integration and national expansion efforts.

Its success in both northeast and southern provinces signals a broadening user base. Lovol's growth has been particularly notable after its integration with Weichai, which enabled higher R&D and manufacturing capacity.

Southern Expansion: A New Frontier

Traditionally, China's tractor market has been focused in the north. But recent years show an emerging trend: companies—especially those based in Shandong—are pushing into the south and southwest, including Tibet, Guangxi, Yunnan, and even Hainan.

For instance, Shandong’s Shifeng captured more than half of Tibet's tractor market in 2020. Meanwhile, Luoyang-based companies have also started moving south, looking to serve what may become the next major growth region for Chinese agricultural machinery.

Conclusion: A Landscape in Motion

The data reveals a highly dynamic tractor market in China, shaped by legacy, user psychology, color branding, and regional needs. While companies such as John Deere have exited the low-horsepower segment, domestic brands have seized the opportunity to localize and expand.

From green to red, from east to west, China’s tractor industry is not just growing—it’s flowing. Understanding these trends is essential for manufacturers, policymakers, and anyone looking to engage with this rapidly evolving sector.

Want to learn more about regional sales insights or partnership opportunities with DS Tractor? Contact us here →